The MahaGST portal is the official online provider for businesses in Maharashtra to handle GST related operations. With all of these, users can register for GST, file returns, make tax payments, and validate GST information. Featuring a user-friendly interface, the portal makes tax compliance easy and time-saving.

Knowledge of the MahaGST portal is of utmost importance for companies to function properly. This guide covers everything from registration to tax filing and payment procedures. Get to know the portal well enough to follow the tax regulations.

What is the MahaGST Portal?

The MahaGST portal is a web based tax management system set up by the Government of Maharashtra. It is developed to assist companies in GST registration, return filing, and tax payment. The portal ensures compliance with Maharashtra’s GST laws.

The MahaGST portal (mahagst.gov.in) is available and alleviates the burden of paperwork in tax procedure. It is a service-in-one that can be used by an enterprise to complete its GST requirements without having to go to government offices.

Key Features of the MahaGST Portal

The MahaGST portal provides multiple services that help businesses manage their tax compliance efficiently. It provides a suite of tax handling features that allow for convenient tax management.

| Feature | Description |

| GST Registration | Apply for GST online quickly. |

| Return Filing | Submit monthly, quarterly, and annual GST returns. |

| Tax Payments | Pay GST and other state taxes securely. |

| GSTIN Verification | Check GST numbers to avoid fraud. |

| VAT Services | Access VAT return filing and related services. |

| E-Payments | Make tax payments directly through the portal. |

The following characteristics enable companies to run efficiently and to maintain tax compliance.

How to Register on the MahaGST Portal?

It is mandatory to register on MahaGST portal for all businesses residing in the state of Maharashtra. The process is simple and can be completed online.

- Visit mahagst.gov.in.

- Click “Other Acts Registration” on the homepage.

- Enter “New Registration under Different Acts.”

- Provide details like your mobile number, email address, and PAN.

- Finish validating the OTP for verification.

- Fill out the application form and attach the necessary documentation.

- Obtain your GSTIN (GST Identification Number) after you have been authorised.

This approach ensures that companies comply with Maharashtra’s GST regulations.

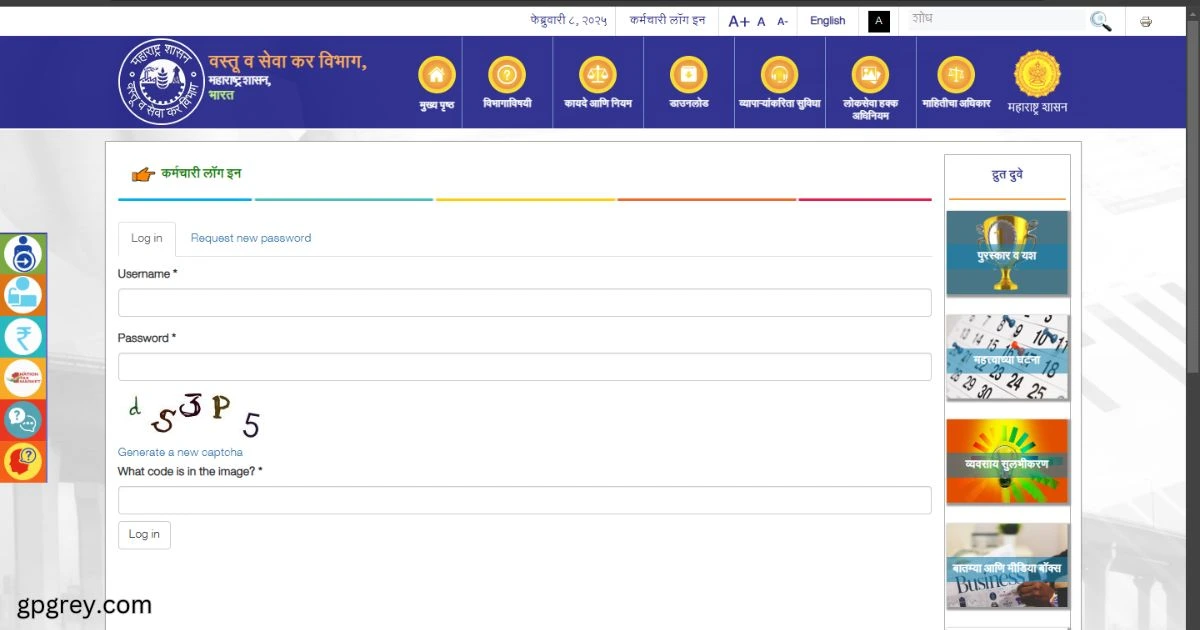

How to Reset Passwords on the MahaGST Portal?

Forgetting a password is common. The MahaGST portal offers simple ways to reset it.

Method 1: Reset via Email

- If your profile was created after May 25, 2016, or December 28, 2017, send an email to mvatresetp@gmail.com.

- Include information such as TIN, PAN, registered mobile number, and email address.

Method 2: To reset using the portal, visit mahagst.gov.in.

- Click the “Forgot Password” button.

- Enter your TIN or PAN and then follow the onscreen instructions.

If the registered email is unreachable, bring the needed documentation to GST Bhavan in Mumbai for a manual reset.

Services Available on the MahaGST Portal

The MahaGST portal provides a variety of tax-related services to simplify compliance. Users can access all GST functions in one place.

E-Services

- Login for VAT and other tax acts.

- Manage registered dealer profiles.

- Access RTO login services.

GST-related services

- GST registration can be completed online.

- GST returns can be filed effortlessly.

- Make sure your GST payments are secure.

- Compare GST rates for various items.

- Confirm the taxpayer’s information.

Electronic payments

- Pay your taxes online instead of visiting an office.

- Make payment on the assessment order.

- Make payments towards the Amnesty Scheme.

These services assist businesses in managing their GST responsibilities properly.

Understanding MahaGST Tax Forms

Different taxpayers must file different GST forms based on their business type.

| Taxpayer Category | Form Required |

| Regular taxpayers | GSTR-9 |

| Composition scheme taxpayers | GSTR-9A |

| E-commerce operators | GSTR-9B |

| Businesses with turnover above ₹2 crore | GSTR-9C |

Filing the correct form ensures compliance with GST rules.

How to Verify a GSTIN on the MahaGST Portal?

Verifying GSTIN helps businesses avoid fraud and ensure compliance.

- Go to maha gst.gov.in.

- Click “Dealer Services”.

- Select “Know Your GST Taxpayer”.

- Enter the GSTIN and click submit.

This verification process confirms the legitimacy of business transactions.

The Significance of the MahaGST State Code

Every Indian state has its own GST state code. Maharashtra’s MahaGST state code is 27.

Example: If a business has the GSTIN 27AACCC8045E1ZN, the first two digits (27) indicate Maharashtra.

This helps in identifying the state of GST registration.

How to Pay Professional Tax on the MahaGST Portal?

Professional tax payments for businesses and individuals can be processed online.

- Visit mahagst.gov.in.

- Click “E-Payments”.

- Select PTEC or PTRC, as applicable.

- Enter TIN and payment details.

- Complete the payment and download the receipt.

.Taking a receipt confirms proof of tax payment.

How to File VAT Returns on the mahagst gov in?

VAT return filing is available for businesses that still need to report VAT transactions.

- Visit mahagst gov in.

- Click “E-Services Login”.

- Select “VAT and Other Acts Login”.

- Enter login credentials.

- Follow instructions to file VAT returns.

This ensures compliance with Maharashtra’s VAT regulations.

How to Register for PTEC on the?

Businesses and professionals liable for professional tax must register for PTEC (Professional Tax Enrollment Certificate).

- Go to the Mahagst website.

- Choose “Other Acts and Registration”.

- Then “New Registration under Various Acts”.

- Click “Next” after selecting PTRC and PTEC.

- Enter your mobile number, email address, and PAN.

- Verify information with an OTP.

- Get a confirmation after submitting the application.

Online professional tax payments are made possible by this registration.

Why Businesses Should Use the MahaGST Portal

The MahaGST portal simplifies tax compliance with various features. It is designed to help businesses manage tax-related tasks efficiently.

- Saves time by eliminating paperwork.

- Secure and encrypted tax payments.

- Reduces errors in tax filing.

- Promises For uncomplicated GST compliance and verification.

Using the MahaGST platform, which guides companies in successfully compliance with Maharashtra’s tax regulations.

Conclusion

The MahaGST portal is a must for the businesses of Maharashtra.It provides a useful tool for handling GST registration, paying taxes, and submitting returns.By using an easy-to-use interface, it guarantees tax compliance without adding unnecessary complexity.

Businesses can utilize mahagst.gov.in to fulfill all GST-related tasks online. The MahaGST website simplifies the processes for professional tax payments, GST registration, and GST information verification.

To ensure a smooth business operation and compliance with Maharashtra tax laws, companies must remain informed about the MahaGST portal.